According to the World Bank, Asia, along with Africa, is urbanizing faster than the other regions in the world and is expected to become 64% urban in 2050 (World Urbanization Prospects, 2014). This fast rate of urban growth means unprecedented need for urban investment in Asia.

In Asia nowadays, several public infrastructures including roads, tunnels and buildings are built in support of private sectors, and the role of private side has become critical in public field. According to UNESCAP’s finding, in 2011-2016, private sector contribution on infrastructure investment is second largest funding source, next to government budget. Government alone may lack of financial resources, and if private resources can be mobilized, government budget can be used in more urgent sectors such as healthcare and poverty.

Since private participation in public infrastructures businesses has gained popularity in Asia Pacific region, it is very interesting to discuss how private corporations can jointly work with governments to create a synergy to improve our society and public lives.

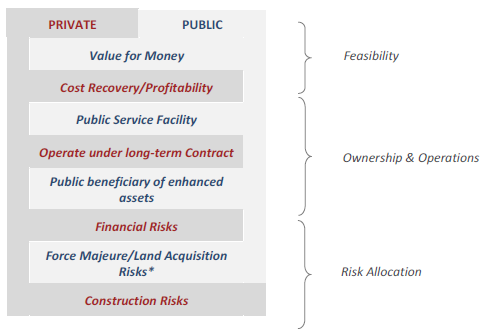

The history of private participation in public services can be traced back to early 1980s starting from the United States and the United Kingdom. In Asia Pacific region, private participation began to sprawl in 1990s to 2000s. To give brief snapshot of what PPP (Public-Private Partnership) is (please note that the definition of PPP is tailored in each country depending on the institutional and legal conditions), generally speaking, it means projects that a local authority can engage private partners to develop urban infrastructure and related services (CDIA PPP Guide for Municipalities, 2010).

By engaging in PPPs, municipal governments and private corporates share risks and financial burdens, and significant risks are transferred to the private side. Usually private side pays for construction costs and gets return on their investment often by project’s revenues. Right after concession, ownership is transferred to municipal governments, private side receives a right to operate facility for several years and when their term ends, facility is returned to public. This type of PPP is called BTO, Build-Transfer-Operate PPP.

There is another type of PPP which is commonly implemented in South Korea, called BTL, Build-Transfer-Lease, where private side operates for certain period and within that period, municipal government lease that facility for operation. There are pros and cons for PPPs and each PPP project bears different risks. PPP projects can, however, be more cost-efficient, facilitates the construction and operation process, and risks and liabilities are reduced for governments.

Figure 1 Partnership and cooperation in PPP (Source: CDIA Guide)

In South Korea, since the late 1990s, government began to support private sector participation actively, and nowadays PPPs cover most of city infrastructures ranging from roads, tunnels, bridges, water management systems, airports, to streams (cheonggye stream). Compared to the late 1990s, in the 2000s, number of PPP projects assigned almost quadrupled in South Korea. Currently there are 46 infrastructure facility types (including road, rail, port, communications facilities etc.) in 15 sectors that are eligible for public-private partnership procurement (Public-Private Partnership Infrastructure Projects: Case Studies from the Republic of Korea, 2011).

“Woomyunsan Tunnel” which passes under Mount Woomyun and connects Seocho, suburb of Seoul to Gwachon and Anyang in Gyeonggi province, is one of the country’s major infrastructures based on BTO type PPP. This tunnel is the first infrastructure project of Seoul Metropolitan Government leveraging private investment.

Private investors paid KRW179 billion for operational control of the tunnel from 2004-2034 with no fee and gets the full rights of all profits. The ownership will be returned to Seoul Metropolitan Government in 2034, after 30 years of operation under Woomyunsan Infraway co.

Woomyunsan Infraway Corporation is owned by multiple investors/shareholders, one of the largest shareholders being Korean Teacher’s Credit Union. Previously, Macquarie was the largest shareholder, but with recent elimination of Minimum Revenue Guarantee (MRG), which basically benefitted private investors at the expense of expensive toll fees, Korean Teacher’s Credit Union became the largest investor. With the elimination of MRG, toll fee has continued to remain at KRW2,50, which is KRW500 lower than the original contract.

Figure 2 Woomyunsan Tunnel (Source: CityNet)

Figure 3 Woomyunsan Tunnel Site Visit (Source: CityNet)

It took about 4.5 years to build this tunnel, and it began operating in January 2004. The aim of Seoul Metropolitan Government when signing a contract with private partners to build this tunnel was to distribute heavy traffic between Seoul and Satellite cities and to encourage private investment for social infrastructures.

Nowadays, approximately 35,000 cars pass through Woomyunsan tunnel each day and this is expected to increase to approximately 50,000 cars daily after 2023. Although the current volume is not as high as initially expected (only 70% expected at the plan stage), it will continue to increase and this tunnel is expected to operate soundly as a gateway linking Seoul and Satellite cities in Gyeonggi province to make commuting faster and more efficient.

By Taekyung Koh

By Taekyung Koh

Taekyung received Bachelor’s at Emory University in the United States and currently studying International Commerce at Seoul National University Graduate School of International Studies. Her interest area is economic development and sustainability. Taekyung has work experience as a market researcher at global market research firm before starting her master’s program, and was mainly in charge of international market research and overseas partner development.

Sources:

Infrastructure Financing, Public-private Partnerships, and Developmnet in the Asia-Pacific Region, 2015, United Nations ESCAP

World Urbanization Prospects, 2014, World Bank

CDIA PPP Guide for Municipalities, 2010, CDIA

Public-Private Partnership Infrastructure Projects: Case Studies from the Republic of Korea, 2011, J.H. Kim, J.W. Kim & Choi

Public-Private Partnerships in China’s Urban Water Sector, 2008, Zhang, Mol & Fu

http://terms.naver.com/entry.nhn?docId=1826486&cid=42151&categoryId=42151

http://terms.naver.com/entry.nhn?docId=1826485&cid=42151&categoryId=42151

http://www.adb.org/sites/default/files/publication/29032/ppp-kor-v2.pdf

http://go.seoul.co.kr/news/newsView.php?id=20160115014021

http://media.daum.net/society/nation/seoul/newsview?newsid=20160114173017995

http://blog.naver.com/seoulwonsoon/220598663559

http://siteresources.worldbank.org/ECAEXT/Resources/Day3Session13_3.pdf